Using customer data is essential to connect with your audiences and stay competitive. Customer Data Platforms (CDPs) are the most effective tools for collecting, consolidating and centralising customer data, so it can be analysed, segmented and activated across different marketing solutions.

In recent years, there has been a shift towards a 'composable' CDP architecture, which integrates seamlessly into a company’s existing technical stack – particularly their data warehouse. Among the players in this emerging category, Hightouch has managed to capture significant attention as a partner to many leading businesses seeking top-tier data management solutions.

But what alternatives to Hightouch exist, and what differentiates them?

👉🏼 In this article, we look at the most popular CDP alternatives, their features, and the advantages of each solution, so you can make an informed choice for your business.

What is Hightouch?

A brief history of Hightouch

Two of Hightouch’s founders, Josh Curl and Tejas Manohar, met while working at Segment (Twilio). Already aware of the challenges around using customer data in marketing campaigns, they also observed the rapid adoption of cloud-based solutions for data storage.

They then set out to create a simple solution to help business teams make sure of the data stored in data warehouses. Hightouch is known for its best-in-class data integration capabilities, making it an essential tool for modern businesses.

At the beginning of the adventure, Hightouch was a Reverse ETL solution (data pipelines from a source to destinations), designed for data teams. Over time, Hightouch has evolved and now addresses both the needs of data teams (automating their data flows) and the needs of marketing teams (covering all the use cases of a traditional CDP).

Hightouch is now what is known as a 'Composable CDP'. It offers all the features and capabilities of a traditional CDP, but integrates seamlessly into the existing data infrastructure (instead of operating as a separate entity).

With Hightouch, companies can drive revenue by building omnichannel journeys and amplifying touchpoints with their customers, all with enhanced personalisation.

If you want to learn more about DinMo, download our comparison with Hightouch and feel free to contact us!

👇

Key differences between Hightouch and DinMo

How does Hightouch work?

To start using Hightouch, you simply connect a source that centralises all your customer data (most often, a data warehouse). Note that Hightouch offers a library of SDKs (“Hightouch Events”) facilitating the collection and storage of data in your data warehouse to complement the data you have already centralised.

Hightouch then allows you to consolidate and organise data to create a 360° view of your customers, notably thanks to its identity resolution capabilities. This customer view is directly actionable thanks to Hightouch’s two flagship products:

Customer Studio: A suite of no-code features that allow you to build audiences and orchestrate campaigns

Reverse ETL: An activation platform that lets you sync your customer data with any destination (marketing, support, operations, etc.)

Note that Hightouch also offers several products to improve marketing operations:

Personalization API: A 'low latency' API that supports certain real-time use cases, such as personalisation

Match Booster: A solution that provides third-party data to enrich your first-party data and boost matching rates in advertising platforms

Campaign Intelligence: A suite of analytics tools and an AI co-pilot to measure marketing campaign performance

It's also worth noting that Hightouch ensures the security and governance of your data, maintaining it within your existing infrastructure for optimal control and compliance.

Alternatives to Hightouch

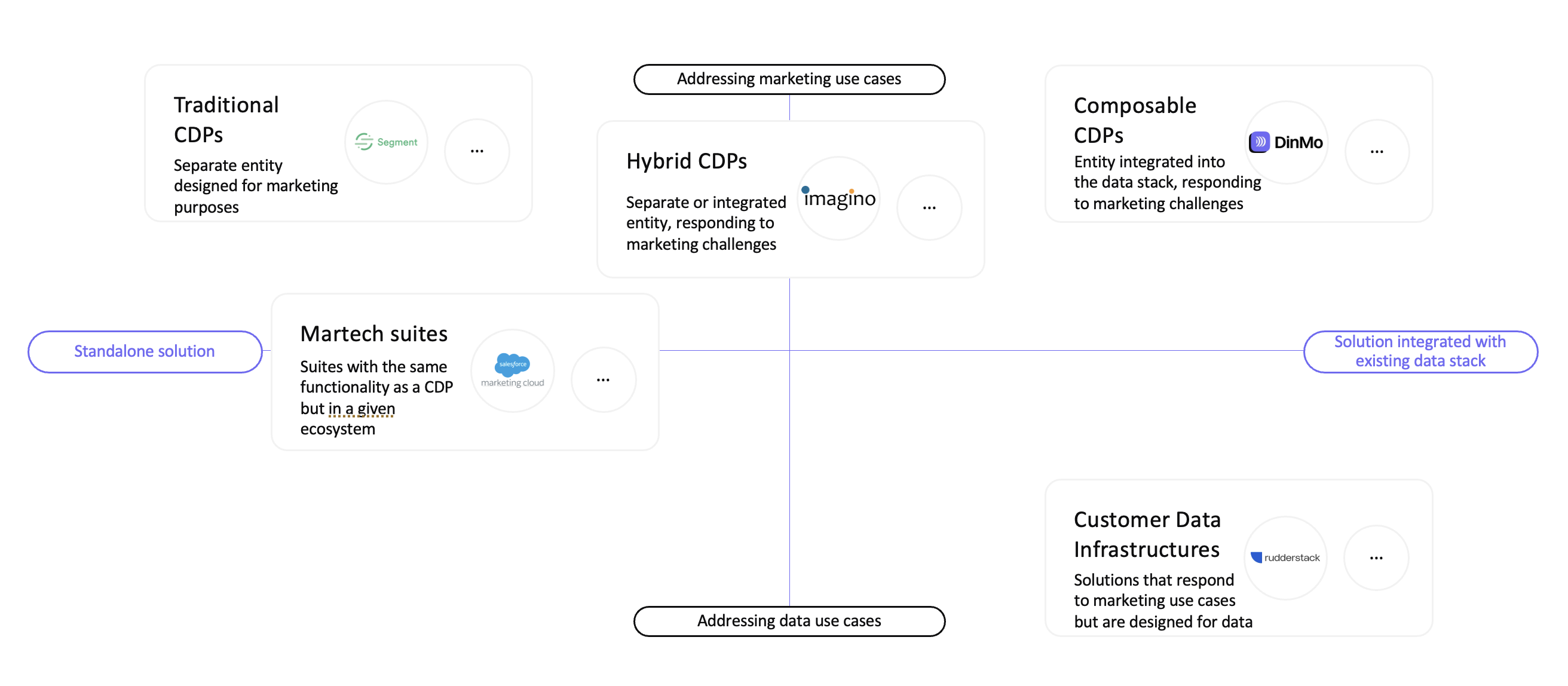

In the rest of the article, we detail the main competitors of Hightouch, divided into different categories of CDP:

Composable CDPs, the closest alternative in terms of architecture

Infrastructure solutions, covering the full range of CDP use cases, but primarily aimed at data teams

Traditional CDPs

CRM suites

We recommend using a Composable CDP if you want to overcome the limitations of traditional CDPs (rigid data model, data duplication in a third-party database, time and difficulty of implementation, cost).

Categories of CDP

Alternative #1: Other Composable CDPs

DinMo

DinMo is a Composable CDP that offers essentially the same features as Hightouch:

A Reverse ETL engine that sends data from a data warehouse to underlying marketing destinations. Real-time use cases are also supported.

A 'Customer Hub' product, a suite of no-code features that allow you to build audiences and orchestrate campaigns.

An AI copilot that helps analyse customer data and measure campaign performance.

That said, DinMo outperforms Hightouch with its non-technical features (user-friendly interface, no-code segment builder, etc.), available on all plans. Designed first and foremost for business teams, DinMo is more user-friendly for marketers, bringing it closer to the interfaces of traditional CDPs.

Indeed, 'Customer Studio' is only available on the 'Enterprise' plans, which can quickly become expensive for marketing teams looking to cover their use cases independently.

Additionally, DinMo differentiates itself through its artificial intelligence and machine learning capabilities, enriching the 360° view available in the Customer Hub with predictive attributes such as LTV, churn, and more.

Criteria | DinMo | Hightouch |

|---|---|---|

No-code segment builder | ✅ No-code segment builder designed for business teams. | ⚠️ Customer Studio (no-code): available on Business plans only. Requires upfront setup by data teams. |

Data model | Flexible data model with mapping and enrichment to easily activate warehouse data. | Multiple modelling approaches (optional SQL) based on the warehouse schema. |

Profile view | ✅ Customer Hub: unified profile view designed for business exploration and activation. | 🚫 Some audience-level insights in Customer Studio. No dedicated profile hub. |

Identity resolution | Identity resolution and unification to activate reliable audiences | ID resolution / matching based on activation needs |

Omnichannel activation / Reverse ETL | Reverse ETL to activate audiences across key marketing tools (CRM, CEP, email, ads, etc.) | Omnichannel activation via Reverse ETL. |

User experience | ✅ Time-to-value–oriented experience built for business teams (fast path from segmentation to activation) | ⚠️ Often requires more configuration and governance from data teams |

Specific destinations | Large catalogue of destinations, with the ability to address custom needs depending on client context. | Large catalogue of destinations. |

Web & App tracking | Web & App Tracking (modern, privacy-first / server-side approach) | Hightouch Events + warehouse-centric tracking |

AI marketing | ✅ Predictive attributes (e.g. churn risk, LTV) + recommendations / decisioning to activate the best audiences and actions. | ⚠️ Recommendations via the Intelligence module / “AI decisioning” (Business tier): ML-driven, model-led approach. |

Security & compliance (GDPR, CCPA) | ✅ GDPR by design: native features to manage data subject rights (export, deletion, purge / right to be forgotten). CCPA, SOC 2 Type II | GDPR / CCPA compatible, with dedicated workflows (e.g. deletion) that are more process- and configuration-driven |

Enablement & marketing expertise | Hands-on support and expertise across marketing use cases (retail, media, finance, D2C, B2B, etc.). Europe-based teams. | Platform-first approach, strongly oriented towards data teams and large-scale activation. |

Pricing | ✅ More transparent and predictable pricing approach. | ⚠️ Variable pricing based on modules (Business tier + add-ons), with usage-based components making budgets harder to forecast. |

Key differences between DinMo and Hightouch

Census

Census, formerly a key competitor of Hightouch in the Reverse ETL space, now brands itself as a “Universal Data Platform,” suggesting it extends beyond typical Composable CDPs.

Like Hightouch, Census offers features that cover all CDP use cases (identity resolution, Reverse ETL, “Audience Hub,” etc.). Their pricing models are quite similar and the capabilities/performance of each are at the same level.

However, Census has expanded its offering with a new set of features primarily aimed at technical teams, introducing capabilities in data transformation and governance. The company was acquired by Fivetran in May 2025.

Alternative #2: Data Infrastructure Solutions

Rudderstack

RudderStack offers an infrastructure dedicated to the collection, processing, and storage of customer data through its various products (data collection, Reverse ETL, ID graph & Identity resolution, etc.). It therefore broadly covers the same use cases as Hightouch and CDPs in general.

However, while Hightouch focuses on both marketing and data teams, Rudderstack focuses solely on building and maintaining a Customer Data Infrastructure (CDI).

Although RudderStack can serve traditional CDP use cases, marketing teams might find it challenging to use independently.

Treasure Data

Treasure Data, initially positioned as a Big Data platform, pivoted to CDPs after recognising that most of its use cases were for marketing teams.

To better address these marketing challenges, features for unification, segmentation, and audience activation have been developed.

Despite this strategic shift, Treasure Data remains a technical solution for data management. It requires technical expertise to use, and data engineering support for implementation and ongoing maintenance. The platform can therefore be more difficult to handle than Hightouch.

⚠️ Unlike Rudderstack, Treasure Data does not integrate seamlessly with a company's existing data infrastructure and instead duplicates data on its own platform.

That said, Treasure Data offers more advanced features in analytics and machine learning applications (especially for predictive use cases).

💡 Note that if you are mainly interested in data activation, you can turn to Reverse ETL solutions, which allow you to send data from a data warehouse to final destinations, without other overlays (Customer Studio, identity resolution, etc.). Popular tools like Grouparoo or Rivery offer general Reverse ETL capabilities.

Note that Composable CDP players (Hightouch, DinMo, Census) also offer the possibility to buy only the Reverse ETL product.

Alternative #3: Traditional CDPs

This category includes all the historical players in the ecosystem. Having been on the market for several years, the features of these CDPs are often highly advanced and cover the entire scope of Hightouch, sometimes even adding artificial intelligence capabilities.

However, these solutions are not flexible and do not support a 'modular' CDP approach. Implementation is long and complex, and the solutions are very costly, even for basic use cases.

👉🏼 Check out our article detailing the differences between traditional and composable CDPs!

Twilio Segment

Segment was initially known and recognised for event tracking. Segment offered SDKs that companies could deploy on their websites to track customer behaviour. The solution was acquired by Twilio in 2020.

Over time, new features were added to build their current CDP: a 'Connections' module to move data from point A to point B, an identity resolution module, and especially a “Twilio Engage” product focused on using audiences to improve customer engagement.

Hightouch and Segment have essentially the same features. The key difference lies in how the data is stored: with Hightouch, it remains within your own data infrastructure; with Segment, it is stored in a separate database hosted by Segment.

mParticle

mParticle is a traditional CDP, initially specialised in mobile event collection. It now offers all the key features of a CDP: data collection, storage, audience management, customisation, and even real-time use cases and predictive attributes thanks to its “Cortex” product.

The platform was designed as an alternative to Segment and is therefore very similar. However, mParticle tends to offer more advanced capabilities across all features.

⚠️ Both solutions were originally intended for a 'technical' audience and may require some time to be adopted by marketing teams.

Alternative #4: CRM Suites

Aware of the growth of the Customer Data Platform (CDP) market, an increasing number of players — such as CRM and Marketing Automation solutions — are attempting to market CDP modules.

These modules are often less mature and generally offer fewer features than traditional CDPs. However, they can provide a quicker return on investment thanks to shorter implementation times and the ability to deploy initial use cases within a few weeks.

Be careful though:

They are generally less effective in terms of data security and governance.

Changing CRM / Marketing Operations tools also involves changing CDPs, which can lead to a long and costly project again.

They are generally less mature and therefore less effective in terms of proposed features.

If you want to learn more about DinMo and its advantages over Hightouch, feel free to contact us! ☕️