Driving upsell performance with customer data

8min • Last updated on Dec 23, 2025

Olivier Renard

Content & SEO Manager

[👉 Summarise this article using ChatGPT, Google AI or Perplexity.]

Short, Tall, Grande, Venti. We’ve all experienced it: at Starbucks, you order a coffee and suddenly you’re faced with four sizes. It’s hard to resist choosing a larger one than you originally planned.

Trading up has long been used by brands as a lever for growth. The goal is to increase the value of a purchase by presenting the best offer at the right moment.

Key Takeaways:

Upselling is the practice of offering a higher-tier version of a product or offer to increase the value of a sale.

By encouraging customers to trade up, it differs from cross-selling, which involves adding a complementary product or service.

Upselling works in both B2B and B2C and relies on a strong understanding of customer needs. It requires a subtle balance to avoid harming the experience.

A Customer Data Platform (CDP) makes this approach easier. With unified customer data enriched by AI, it helps you present the best offer to improve performance without bombarding customers with unnecessary messages.

👉 What is upselling, and how can you use it without slipping into pushy sales tactics? Discover best practices, real-world examples and a simple method to increase customer value. 🔍

What is upselling?

Upselling is the practice of offering a higher-tier version of a product or service instead of the “standard” option initially considered.

It’s also referred to as trading up or an upsell offer.

It’s widely used by brands, both online and in-store. In practice, it can take the form of a premium plan, higher capacity, a more comprehensive service, an extended warranty or an upgrade.

An upsell works when the perceived value is clear and the offer better matches the customer’s needs.

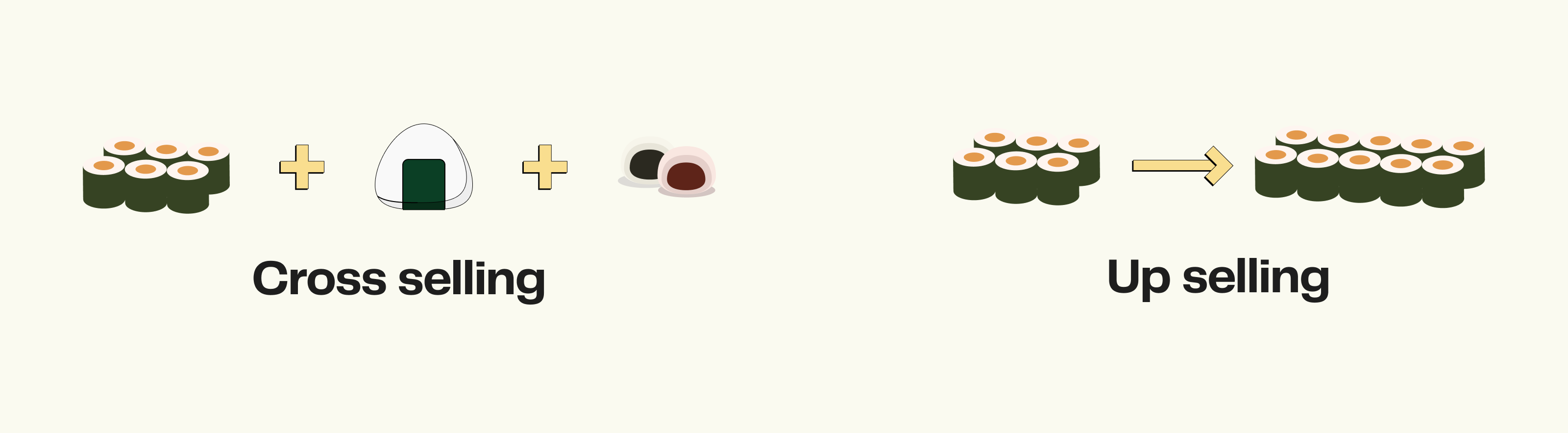

Upselling vs cross-selling: what’s the difference?

The two are often confused, but the distinction is simple. Upselling encourages customers to trade up, while cross-selling adds a complementary product or service.

Imagine you’re eating at your favourite Japanese restaurant:

You were going to order the lunch set with 9 maki, but end up choosing the 15-piece set: that’s an upsell.

You stick with the lunch set and order a dessert at the end of the meal: that’s a cross-sell.

Cross selling vs. up selling

In practice, it’s common to combine the two. Conversely, a downsell involves offering a cheaper alternative to avoid losing the sale (for example, when a customer has budget constraints or is hesitating).

What is upselling for?

Benefits for the business: upselling increases the value of a purchase — and therefore average order value, margin, and potentially CLV.

It improves profitability because it’s often less expensive to sell a higher-tier option to an already engaged customer than to start from scratch with a new prospect.

Benefits for the customer: when done with the right balance, upselling can also improve the experience. The customer gets an offer that better fits their needs, with fewer limitations and greater convenience.

Trading up then becomes a useful choice, not sales pressure.

The best moments in the journey

An upsell works when it fits naturally into the buying journey. The right moment depends on the context and on a perfect alignment with the customer’s needs.

Before purchase: when the customer is comparing options

This is the most common stage to propose a trade-up. The customer is hesitating and comparing different offers, looking for the best option to meet their needs.

At this stage, upselling is about making the differences between tiers easy to understand. This can take the form of a good / better / best presentation. The key is to explain what the higher-tier option genuinely adds, without overwhelming the user with detail.

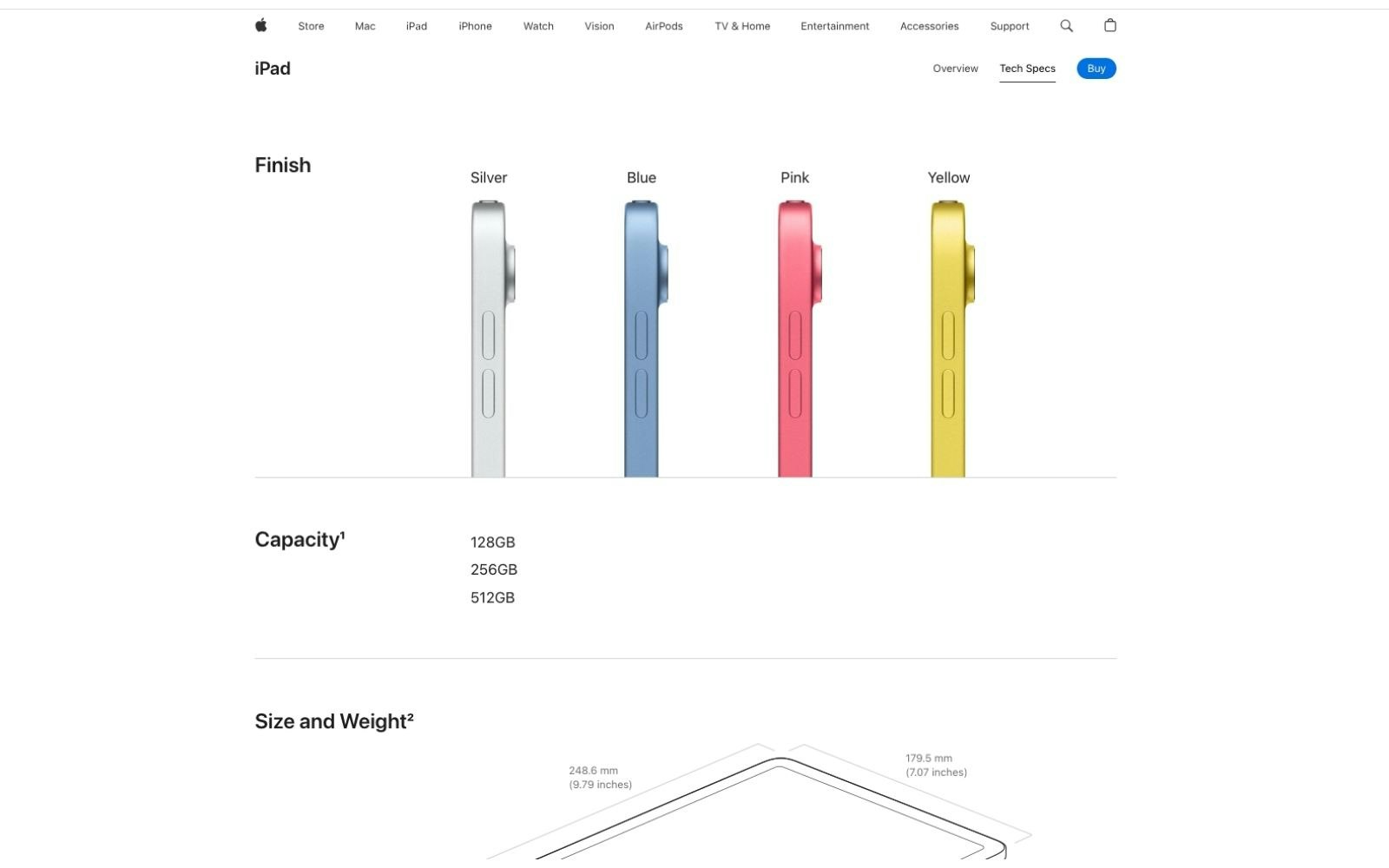

💡 On Apple’s website, choosing storage (128, 256 or 512GB) naturally encourages customers to consider a higher capacity — even before they reach checkout.

Colors, capacity, and size of the iPad on the Apple website

During purchase: at checkout, friction-free

At basket or payment stage, the customer has already made their decision. It’s a sensitive moment. To be effective, the upsell must stay simple: one option, a clear benefit, and a one-click add-on.

💡 On easyJet or Booking, it’s common to see an upgrade offer when finalising a reservation. The upgrade fits naturally into the flow, without slowing conversion or creating frustration.

Credit: Easyjet

After purchase: at the right moment in usage

Post-purchase offers strong upselling opportunities. The offer can be made when satisfaction is high, when usage increases, or when a limit is reached.

A subscription renewal or a well-resolved support interaction are often good moments to upsell. From a growth marketing perspective, it’s ideal timing.

Upselling doesn’t come across as a more expensive option. It removes a barrier, adds convenience, or unlocks a feature.

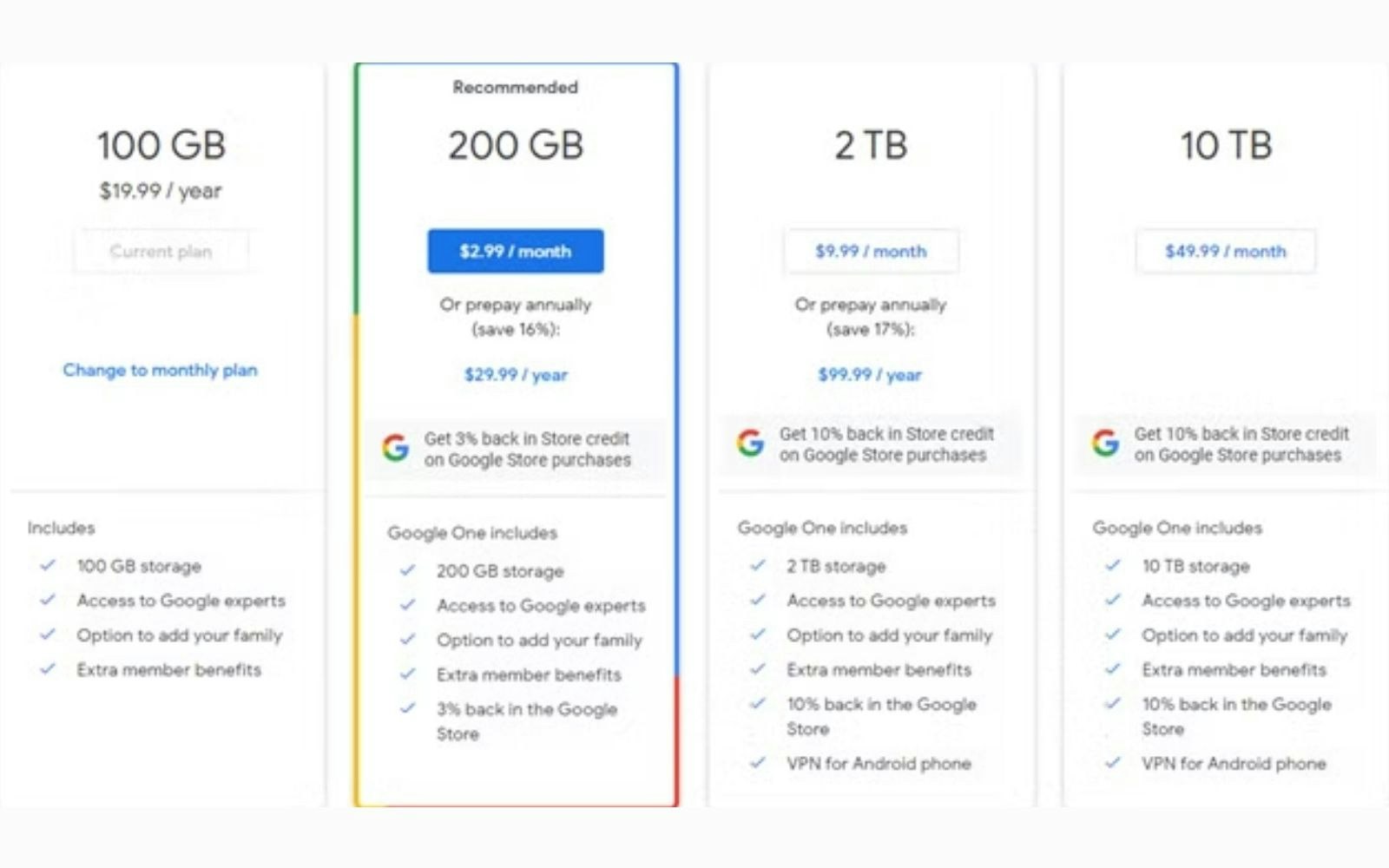

💡 Google Drive (Google One) suggests trading up when a user is nearing their storage limit. The need is immediate, so the decision feels more natural.

Google One Subscription (Source: Google)

Sector | Common upsell formats | Journey stage | Trigger signal |

|---|---|---|---|

E-commerce / retail | Higher-end product, “premium” version, premium bundle, extended warranty, express delivery | Pre-purchase or at checkout | Repeated views of a higher-end range, product comparison, high basket value, hesitation at payment |

SaaS / subscription | Plan upgrade, add-ons, additional seats, premium support, advanced features | Post-purchase (usage) or at renewal | Threshold reached (quota, storage, users), heavy usage of a feature, spike in activity, renewal approaching |

Services (banking / insurance / travel…) | Enhanced coverage, flexibility options, assistance, upgrade, priority services | Pre-purchase or just after (confirmation) | Choosing a “standard” option then reviewing cover, risk/comfort consideration, high-value purchase, urgent context (departure soon) |

Purchase, usage, browsing, a threshold reached, renewal or support: these signals make it possible to trigger an upsell at the most opportune moment. Your offer is useful and relevant, so it is more likely to be accepted.

Building an upselling strategy that works

An upselling strategy follows a simple logic: create value, target the right people, and stay consistent throughout the journey.

1️⃣ Start with value, not the catalogue

What genuinely improves the experience? An effective trade-up delivers a clear benefit: greater convenience, fewer limitations, or a service that saves time.

Define two or three priority upsells that are easy to understand and easy to compare.

2️⃣ Identify the right segments

Upselling is aimed at customers with real potential. This shows up through regular usage, affinity for a category, high CLV, or an evolving need.

Depending on the context, you can rely on RFM segments, lifecycle stage, product usage, satisfaction, or churn risk. The goal is to offer a higher-tier option to those who will see the value in it.

3️⃣ Choose the right channel and the right message

Email, SMS, push, in-app, sales, ads… the channel depends on timing, engagement level and your objective.

To be convincing, the message should stay simple and get straight to the point. Highlight one main benefit, add proof, and minimise friction as much as possible.

4️⃣ Measure and iterate

A good upsell should be judged by its impact on conversion, margin and CLV. Where possible, it’s worth testing multiple approaches.

Compare the offer, timing and channel, then measure the impact on your results, segment by segment.

Pitfalls to avoid

The most common mistakes:

Offering too early, at too high a price, or without an obvious value.

Presenting so many options that it creates confusion for the customer.

Ignoring the context (a customer at risk of churn, an unresolved support issue, an urgent need).

Creating irritation through excessive sales pressure.

The goal is to increase the value of the relationship without harming the experience.

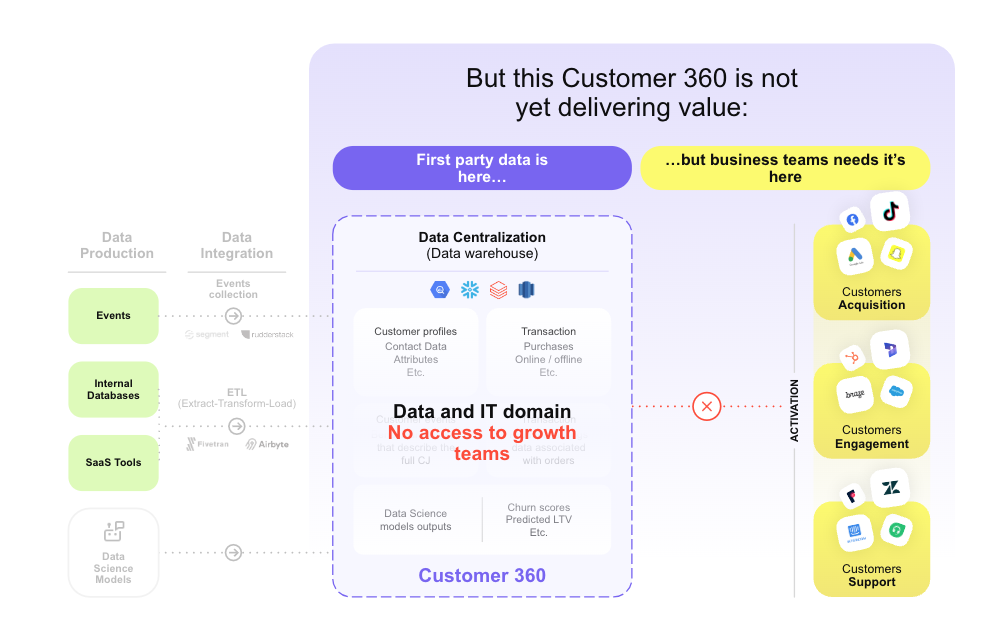

Customer 360 is only valuable if it is accessible to business teams

Why data changes everything

A successful upsell strategy depends on your ability to define your target audience, know what to offer, and choose the right moment to do it. Data makes it possible to roll these actions out at scale.

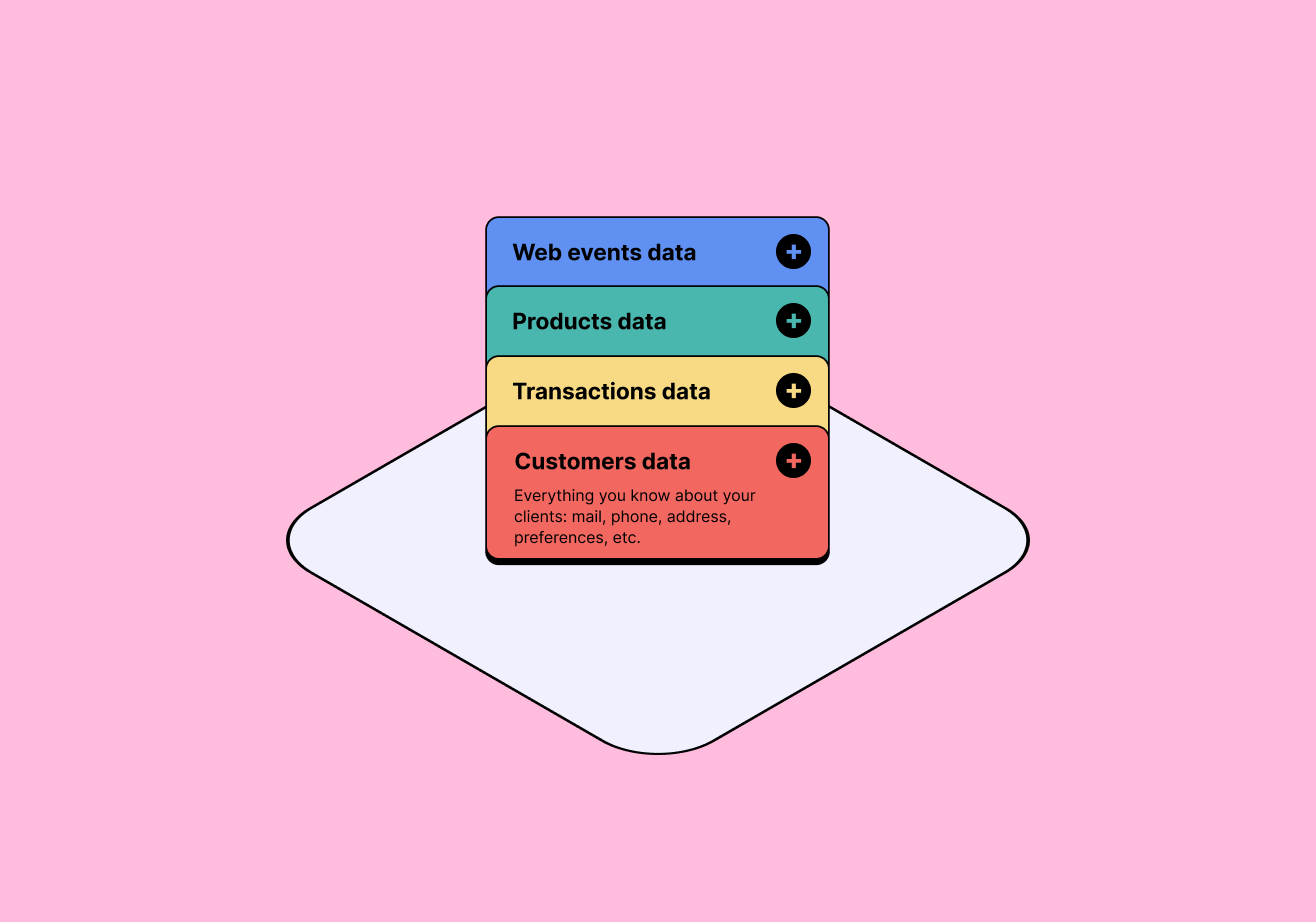

Unify your customer data to target more accurately

Many companies still operate in silos. Information is scattered across physical stores, websites, apps, CRM systems and support tools – and each team only has a partial view of the journey.

You can build a coherent view by bringing your data together on a unified foundation. You know what someone has already purchased, what they actually use, and where they are in their lifecycle.

This helps you avoid offering an upgrade to customers who simply won’t need it.

Signals and scores

To be effective, upselling relies on clear signals: engagement, frequency, satisfaction, interest in a product range, as well as potential value.

Scores such as churn risk, LTV or product propensity help you prioritise the right audiences and identify the Next Best Offer.

Choosing the right timing

The right moment isn’t a gut feeling – you can spot it through triggers. For example:

Several visits to a pricing page,

A high basket value,

A threshold reached,

Increasing usage,

An upcoming renewal,

A support interaction that’s been resolved successfully.

These signals make it possible to propose an upgrade when it’s genuinely useful, without slipping into pushy sales tactics.

The role of a composable CDP in your upsell scenarios

DinMo’s composable CDP makes this approach easier by making your customer data ready for activation, without unnecessary complexity. It brings customer data together into a unified profile and makes it easy to create dynamic, no-code segments (RFM, CLV, propensity, behaviour).

DinMo includes an intelligence layer, with predictive attributes and AI decisioning capabilities to power Next Best Action scenarios. Our CDP also makes omnichannel activation smoother: data is synced to your CRM, email, in-app and Ads tools.

The Customer Hub acts as a cockpit for day-to-day data usage. It provides a 360° view of profiles, highlights AI scores, and lets you define KPIs to steer performance by audience.

Conclusion

Upselling is an effective lever for driving growth from your existing customer base — as long as you stay focused on value and choose the right moment. Done well, it improves profitability without harming the experience.

By unifying data from multiple channels, a Customer Data Platform makes this approach easier. It helps you identify the right profiles, trigger the right actions, and measure their impact.

Want to orchestrate your upsell scenarios and activate your audiences more easily? Discover how DinMo helps marketing teams segment, activate and steer their campaigns.

FAQ

What factors influence a customer’s decision to accept an upsell?

What factors influence a customer’s decision to accept an upsell?

The decision to accept an upsell often depends on how the offer is perceived. A clear comparison between tiers reinforces the feeling of “getting more” for a small difference in price.

Urgency or scarcity cues can speed up the decision. Reviews and trust badges provide reassurance. Finally, a bonus, a reward or an option that makes life easier reduces hesitation.

What’s the difference between upselling in B2B and B2C?

What’s the difference between upselling in B2B and B2C?

In B2C, upselling often aims to increase average order value and is decided quickly — at checkout or shortly after purchase.

In B2B, upselling relies more on usage, ROI and the commercial relationship, with longer sales cycles.

In both cases, granular segmentation and a Customer Data Platform (CDP) help you target the right people.

How do you measure the effectiveness of an upselling strategy?

How do you measure the effectiveness of an upselling strategy?

A successful upsell has a direct impact on the revenue generated. You should track conversion, margin, LTV and overall profitability.

Compare exposed vs non-exposed audiences, ideally using A/B tests or control groups. Segment by segment, you can identify what truly improves performance without degrading the customer experience.