Best alternatives to Simon Data

6min • Last updated on Jan 5, 2026

Olivier Renard

Content & SEO Manager

The Customer Data Platform (CDP) market is evolving rapidly. Studies show it is expected to grow by more than 30% annually by 2030.

Brands are faced with increasingly complex customer journeys. They need tools to unify and activate data at scale. The goal: to deliver a personalised experience across all channels while keeping costs under control.

Simon Data is one of the most well-known players in the market. The American platform has attracted major enterprises thanks to its broad feature set and its use of AI. It offers a hybrid approach, which doesn’t suit every use case.

Looking for an alternative to Simon Data? Unsure whether to integrate it into your stack? Follow the guide!

Key takeaways:

Simon Data is a Customer Data Platform founded in New York in 2014. It is used by major accounts in retail, tech, and finance.

Its core features include unified profile management, advanced segmentation, and omnichannel campaign orchestration.

Simon Data combines a traditional architecture with integration capabilities for Snowflake, placing it in the hybrid CDP category, like Imagino.

Choosing an alternative depends on your data maturity, available resources, and marketing goals.

👉 Find out our overview of the main alternatives to Simon Data. Discover their strengths, limitations, and the key criteria to help you choose the right CDP. 🎯

Simon Data: A hybrid approach to CDPs

History and positioning

Simon Data was founded in 2014 by two data scientists and machine learning experts: Jason Davis and Matt Walker. It operates as a SaaS platform and was one of the first CDPs on the market. Its well-known clients include major B2C brands like Asos, Tripadvisor, and Vimeo.

Simon Data is now positioned as a hybrid CDP. Initially built on a traditional architecture, it now embraces a composable approach centred around the Snowflake cloud data warehouse.

Data is stored in Snowflake tables, either hosted by the client or managed within Simon Data’s Snowflake instance.

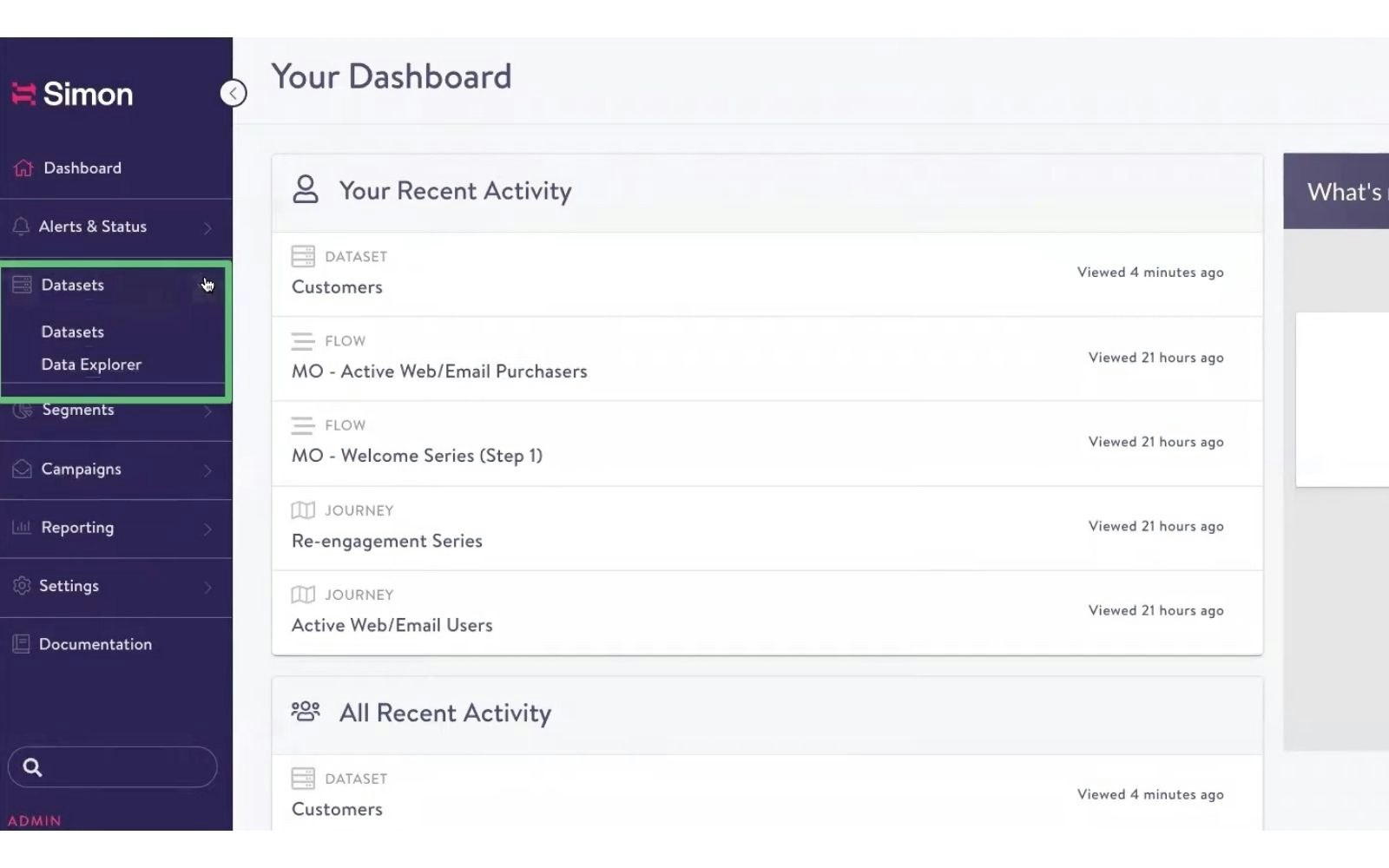

How the platform works

1️⃣ Data collection and centralisation

Simon Data centralises customer information from multiple sources (website, mobile app, CRM, etc.). Its Simon Signal ingestion module collects events from the website or app in real time. The data is then grouped and modelled into datasets.

Simon datasets (source: Simon Data)

2️⃣ Unification and Segmentation

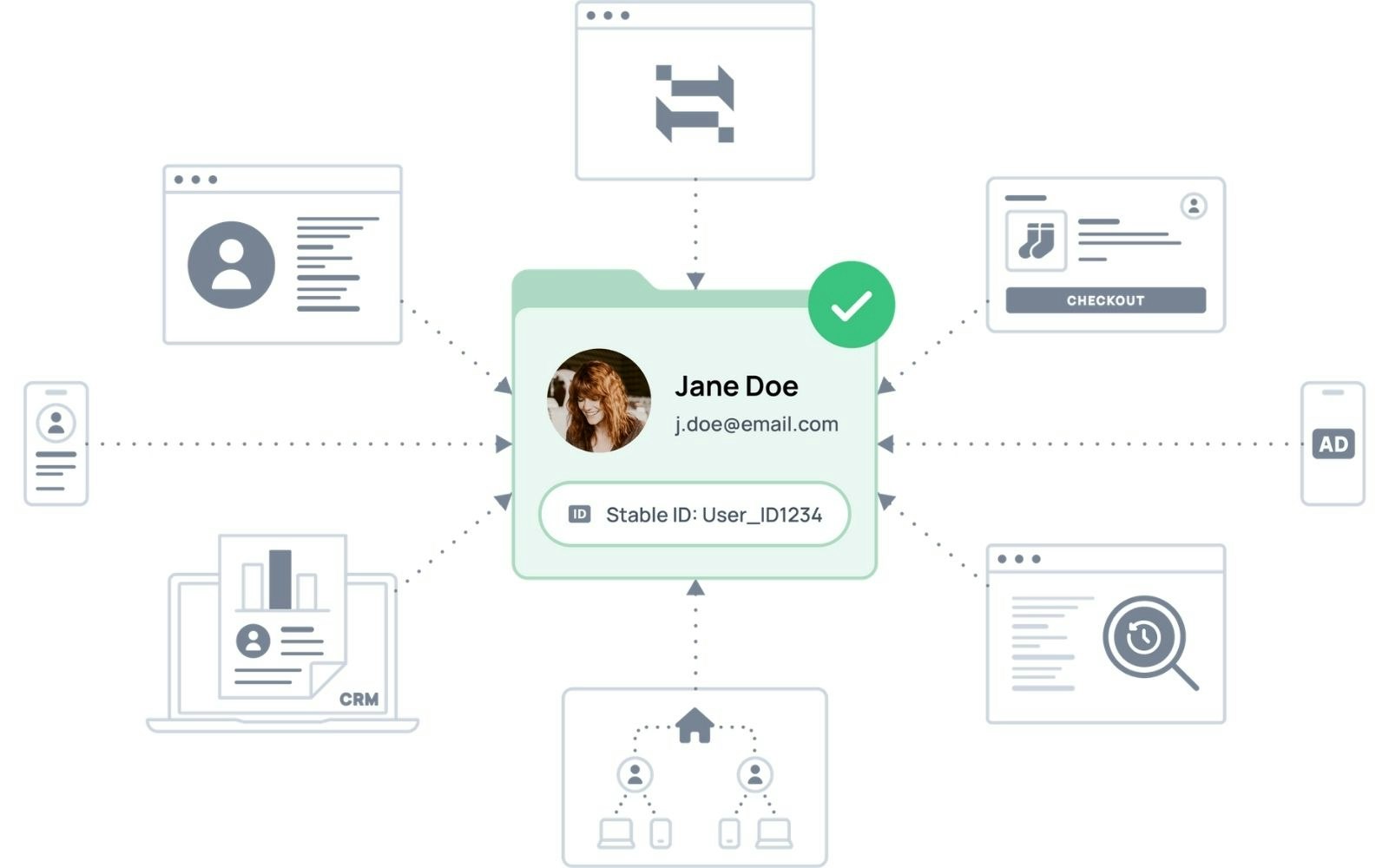

The platform uses a proprietary internal ID (simon_id) to unify user data. Identity resolution features are used to build complete profiles by combining behavioural, transactional, and CRM data.

ID Resolution (credit: Simon Data)

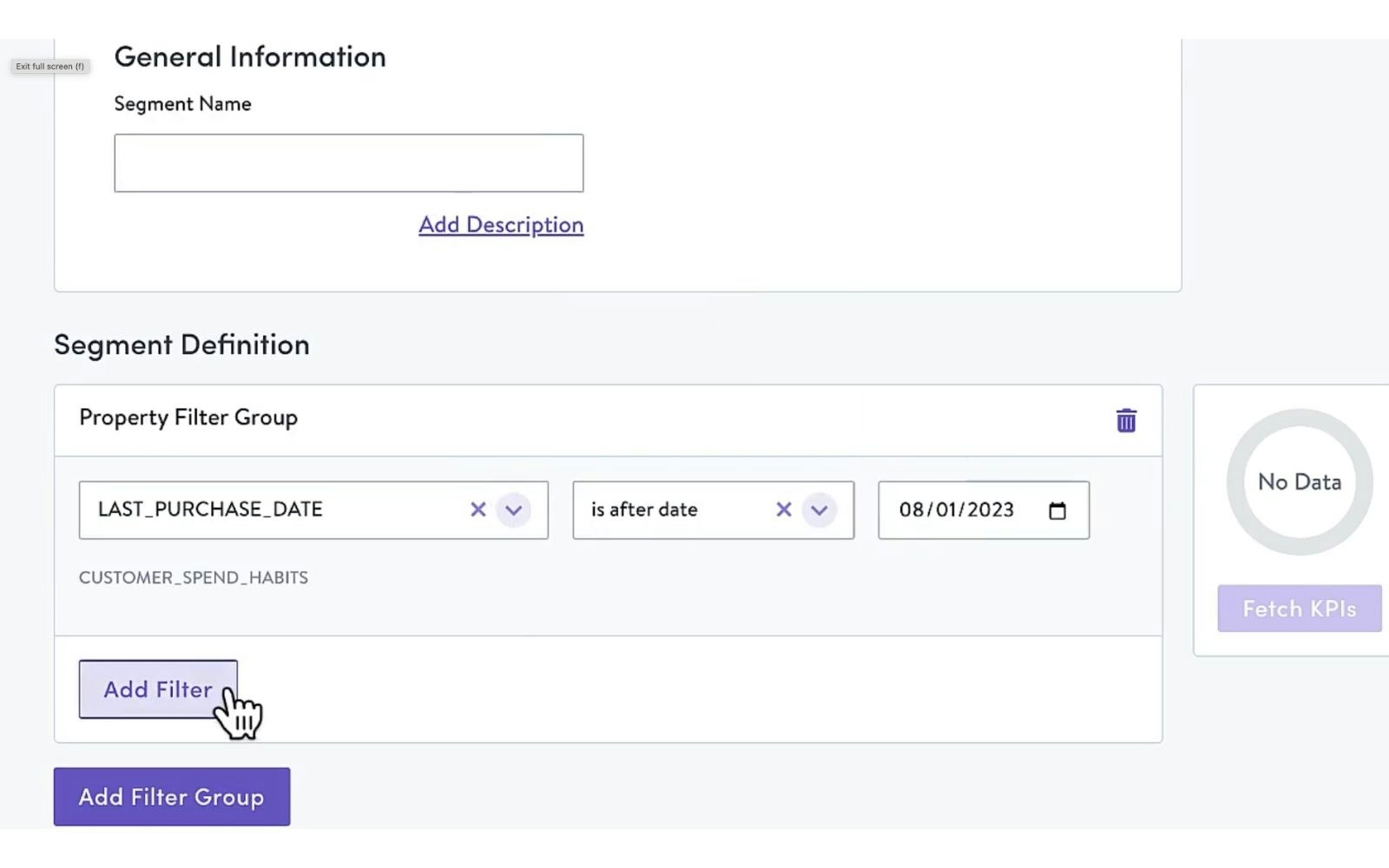

Once unified and enriched, teams can create dynamic segments based on rules or predictive models.

Segment definition (credit: Simon Data)

3️⃣ Data activation and campaign orchestration

The interface allows users to define audiences and trigger activations using engagement flows and journeys. Simon Data includes personalisation features and multichannel campaign orchestration: emails, push notifications, social media, and advertising.

Simon Data journeys (credit: Simon Data)

It also offers advanced capabilities powered by AI: scoring, recommendations, and predictive analytics.

Although aimed at marketing teams, the platform remains fairly technical. It features a graphical UI, but some functionalities still require technical input, which can be a barrier for non-specialist users.

Strengths and limitations

Pros

Native marketing workflow integration. Segment creation, campaign orchestration, and performance analysis are all managed through a single SaaS interface. This simplifies day-to-day tasks for business teams.

Strong personalisation features. Users appreciate the quality of customer support, particularly for complex projects.

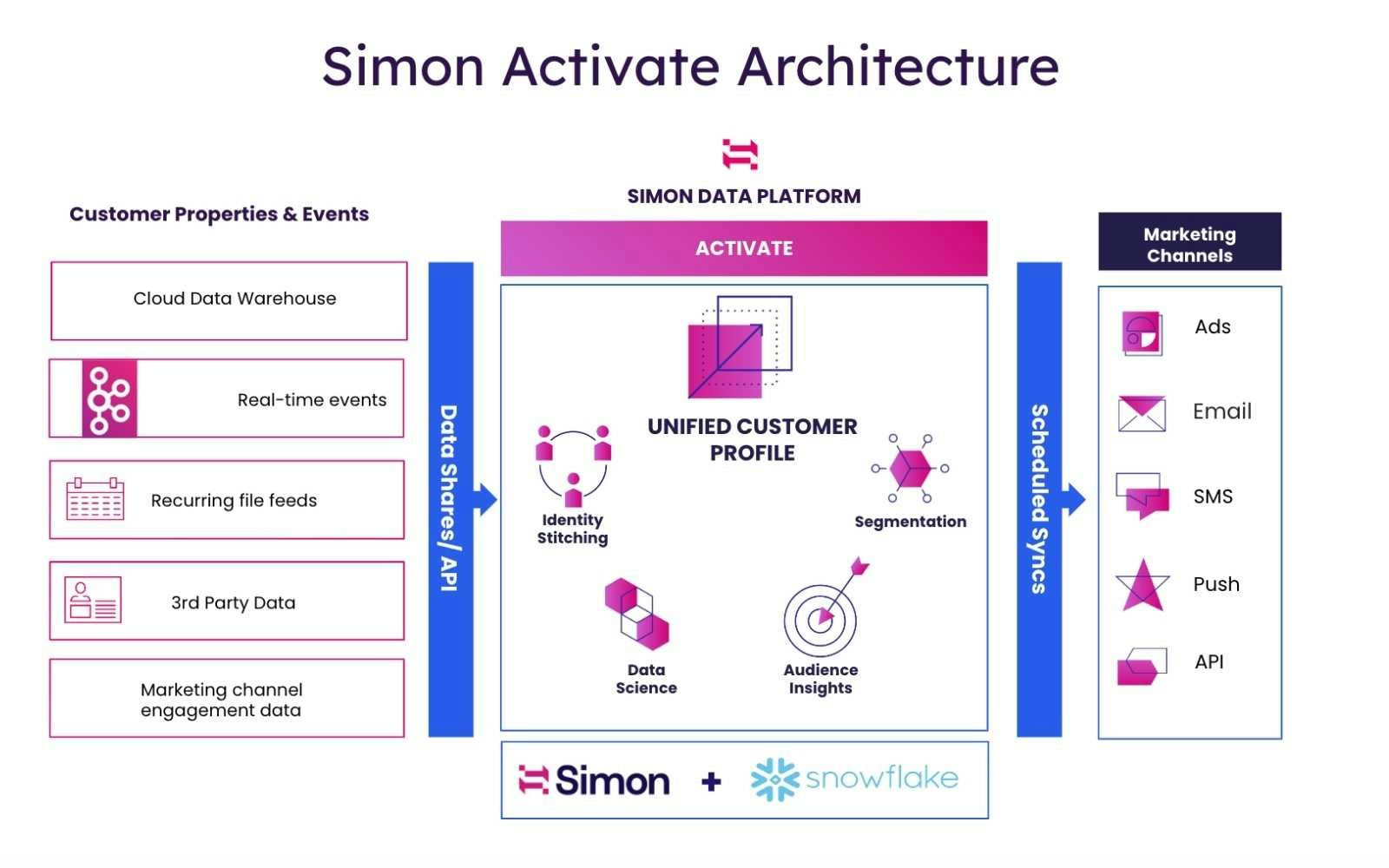

Partnership with Snowflake. For companies already using this data warehouse, Simon Data offers greater flexibility.

The Simon Activate module, launched in 2023 and developed with Snowflake, prevents data duplication and enables real-time audience activation. However, it requires a compatible infrastructure.

Simon Activate x Snowflake (credit: Simon Data)

But this requires a compatible environment.

Limitations

Implementation can be complex and requires the support of a data expert. It typically takes several months, and the vendor must intervene to set up a specific identifier.

It will take some time to get used to all the features.

No native compatibility with cloud infrastructures other than Snowflake. Limited integration with other cloud data warehouses, like BigQuery, Redshift, or Databricks.

Fewer native connectors than modern composable CDPs. Reverse ETL capabilities are still limited, which can hinder omnichannel activation use cases.

Cost may be a barrier for mid-sized businesses. Many features, such as Simon Activate, Real-time Content, or Audience API, are premium options, resulting in significant additional costs.

What are the best alternatives?

Other tools offer different approaches, which may be more flexible or more accessible depending on your organisation’s data maturity. Here’s a breakdown of the main alternatives by CDP type.

Composable CDPs

Composable platforms connect directly to your organisation’s data warehouse. They avoid data duplication and are better suited to teams with a modern data stack.

DinMo

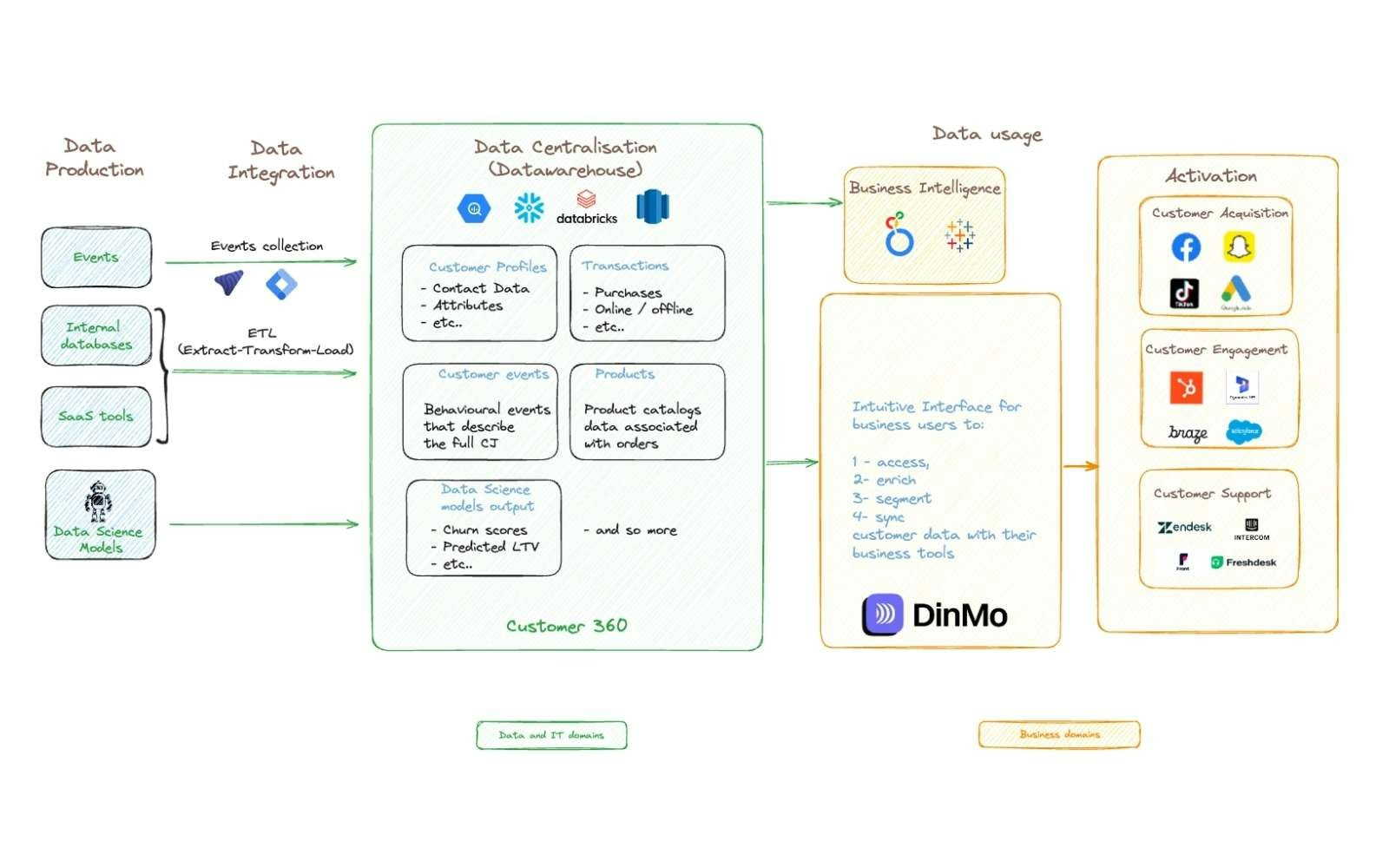

DinMo is a composable CDP built for marketing teams. Key strengths include:

An intuitive interface for no-code segment creation and campaign orchestration: the Customer Hub

A robust Reverse ETL for data activation across all channels: email, social media, advertising, CRM...

An AI copilot that saves time on segmentation and personalisation

Get our DinMo vs Simon Data comparison guide

Other composable alternatives

Hightouch: A US-based CDP initially focused on Reverse ETL. Popular among technical teams and evolving towards marketing use cases.

Census: A composable solution acquired by Fivetran in early 2025. Like DinMo or Hightouch, it connects to the data warehouse for activation.

Thanks to their zero-copy architecture, composable platforms also offer stronger data governance.

How the DinMo composable CDP works

Packaged (traditional) CDPs

These turnkey platforms have their own storage systems and impose a predefined data model. They are better suited to companies without a sophisticated data architecture.

Segment (Twilio): Founded in 2012, it was one of the first CDPs on the market. Initially focused on event tracking, it gradually incorporated identity resolution and activation features.

mParticle: A CDP launched in 2013, originally focused on mobile event tracking. It is Segment’s main competitor among packaged CDPs. Implementation takes several weeks, and its traditional architecture requires data duplication.

Infrastructure CDPs

Customer Data Infrastructures (CDIs) consist of technical components designed for data teams. While not CDPs in the strict sense, they enable custom-built solutions, provided you have sufficient technical resources.

Rudderstack: An open-source, developer-oriented infrastructure with a wide range of connectors.

Treasure Data: A historic Infrastructure CDP, founded in 2011, now gradually evolving into a CDP.

These tools are ideal for technical teams with deep data expertise who can build and manage their own stack.

MarTech suites with built-in CDP modules

Some major marketing suites include CDP modules integrated into their broader ecosystems. Key providers include:

Salesforce CDP – Data Cloud for Marketing: Best suited for companies already using Salesforce, with strong native integration.

Adobe Real-Time CDP: A component of the Adobe Experience Platform, designed for large-scale activations.

These solutions are generally aimed at large enterprises with an established stack around these vendors.

Choosing a CDP ultimately depends on your business needs and the data architecture you want to build. The composable CDP DinMo offers a powerful and scalable alternative.

Fully compliant with data protection regulations, it gives marketing teams a high degree of autonomy. Don’t hesitate to contact us to set up a POC.